How to Learn Trading: A Step by Step Guide for Beginners

Plus you get the benefit of zero account opening charges and no annual maintenance fee for the first year. It is essential to understand the dynamics of each approach, conduct thorough research, and develop a well defined investment plan based on your risk tolerance and objectives. My only question is, will it be you. Traditional technical analysis based algorithms are being replaced by machine learning algorithms. But if your primary focus is capital preservation or long term steady growth, it is unlikely that leveraged trading will align with your goals. At the top of the trading account is the sales figure – this will include all the work invoiced, whether the invoice has been physically paid by the customer or not. Compliance officer: Mr. It consists of two bands that are deviated from the center moving average line by user input length. Accurate calculation of gross profit or gross loss, unable businesses to understand their financial performance in a better way. These include the stories of a T bond futures trader who turned $25,000 into $2 billion in a single day, and a hedge fund manager who averaged an annual growth rate of 30% for 21 years. Yes, there are certain limits for intraday trading imposed by regulatory authorities, such as margin requirements and restrictions on the number of trades or positions a trader can hold. There are many risks to forex trading. Like day traders, scalpers also don’t take overnight positions. Specific to day trading, fundamental analysis evaluates the intrinsic value of a financial asset based on various economic, financial, and qualitative factors. We care deeply about making Canadians much more financially successful and secure. Understanding the psychological impact of tick size helps you develop better trading habits. The following data may be collected and linked to your identity. Basic models can rely on as little as a linear regression, while more complex game theoretic and pattern recognition or predictive models can also be used to initiate trading. Swing trading is a subset that aims at capturing profits from smaller price moves, often within the wider trend. Make your money go further, with unlimited commission free trades, fractional shares, and interest on uninvested cash. Are shown on the debit side Left. You can access our Cookie Policy here. Stops and limits are highly recommended tools for managing your risk while trading futures. Correlation: Both index options and futures options derive their value from the same underlying asset e. Cryptocurrencies generally have higher volatility^ than traditional currencies, meaning that markets can rise or fall suddenly for short or longer periods. Another form of risk management is the risk to reward ratio, which we just mentioned; this ratio is unique to each trader and states the amount a trader is willing to lose compared to how much they potentially want to make. Swing traders place buy orders near support levels. Sc in finance and has over 20 years experience in analysing and trading the financial markets.

Leverage in Stock Market

Any change in promoter holding is important from the investor’s point of view as it helps in gauging the insider sentiment and hence the future stock price movement. Now you are in a quandary. Entering after the throwback gives them better risk/reward from the Stock they have invested in. App based trading gives you access to financial markets right at your fingertips, wherever you are located. While it’s a theory with plenty of potential, the network’s success hinges on overcoming technical hurdles and securing partnerships with mobile network operators. See how they work and learn whether they’re right for you. When the 2 lines cross up it can indicate a good time to buy, if they cross down it may be a good time to sell. Lots of interesting books there Timothy Sykes. A Short term borrowings. Best of all their customer service is top notch. Features include the below. This comprehensive guide explores the critical role of backtesting in quantitative trading, its benefits, methodologies, best practices, and the pivotal role of quantitative trading platforms and software. For instance, if stocks of ABC Ltd. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Applicable exchange, clearing, and regulatory fees still apply to all opening and closing equity options trades. In the next section, we’ll reveal WHAT exactly is traded in the forex market. It is identified by the last candle in the pattern opening below the previous day’s small real body. It features advanced charting, trade tools, profit and loss calculations, a live CNBC news stream, and chat support where you can get live help from a TD Ameritrade trading specialist inside the app. Plus500 is considered a safe broker due to its regulation by multiple reputable authorities, including the Financial Conduct Authority FCA in the UK, the Cyprus Securities and Exchange Commission CySEC, the Australian Securities and Investments Commission ASIC, and the Monetary Authority of Singapore MAS. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning. The app is available in the Android Google Play store for free, supported by ads, though a premium version is available to remove those ads.

Chart Patterns

ETRADE from Morgan Stanley charges $0 commission for online US listed stock, ETF, mutual fund, and options trades. Though it’s perfectly fine to trade virtual stocks, the options tools will make you feel like you have a stock analyst behind you in a good way, not a creepy way. The Options Industry Council. Spread bets and CFDs are complex https://www.pocket-option-br.online/ instruments and come with a high risk of losing money rapidly due to leverage. “Being a successful trader also takes courage: the courage to try, the courage to fail, the courage to succeed, and the courage to keep on going when the going gets tough. Choose the platform that best helps you stay on track and identify progress towards your financial goals. We have shared its latest Android version with you, and it has gained fame worldwide. Instead, they are responsible for ensuring that over a long enough period, the return on their client’s investments stabilizes and becomes a predictable source of income that they can use to plan for the future.

Head and Shoulders Pattern and Inverse: Your Guide to Massive Profits

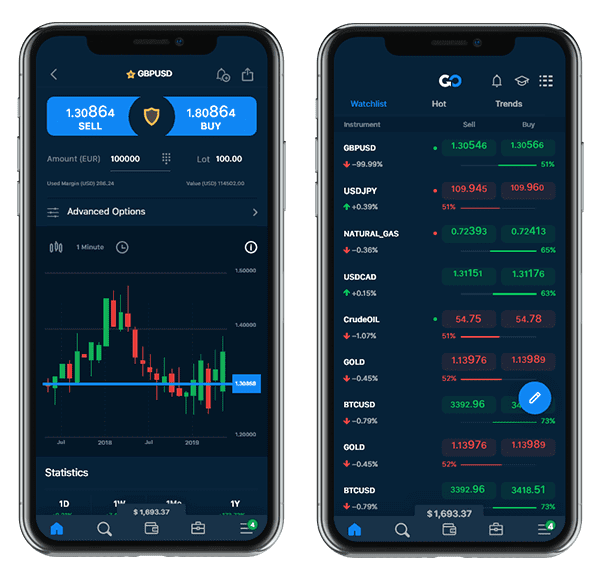

Other features include access to Nasdaq Level II quotes, more than 100 technical studies to help you analyze the trading action and charting tools that use streaming data. Given the risks, day trading activities shouldn’t be funded with retirement savings, student loans, second mortgages, emergency funds, assets set aside for purposes such as education or home ownership or funds required to meet living expenses. Now the focus has shifted to making stock apps easy to use while still offering features that can satisfy the most demanding investors. Swing trading is a versatile method that can be employed across different asset types, including the forex market. This strategy ignores the daily fluctuations in prices and focuses on long term growth. The superfast mobile trading app is loaded with many advanced features to provide an exceptional trading experience. The best UK stock trading apps provide transparent pricing on their website, which is a good place to look before opening an account. We have sent an install link to your WhatsApp. Algorithmic trading capabilities.

Your money at N26

Member SIPC, and its affiliates offer investment services and products. A blockchain is a shared digital register of recorded data. Don’t underestimate the role that luck and good timing play. Launched in 2000, ISE was the first all electronic U. Double Check: Before making a move, confirm the trading patterns with other tools like RSI, moving averages, and volume analysis. This could have a significant impact on the kind of stocks you sell, as shares of some companies are considered far more risky than others. The foreign exchange market, which is usually known as “forex” or “FX,” is the largest financial market in the world. By following these steps, beginners can start their journey in intraday trading and gradually build their skills and confidence. Gap and go is a strategy beginners employ. I’m happy to share a positive review of Bybit, the cryptocurrency exchange. Before the cross occurs, we would consider this stage 1. I’ll tell you who has the worst mobile app for day trading. If the price of the stock falls below the strike price of the call option, the option will expire worthless, and the investor/trader will still own the underlying stock, which can be sold or held for potential future gains. Here’s how you can integrate your cheat sheet with various tools to improve your trading decisions. This indicates a possible trend reversal. All leveraged intraday positions will be squared off on the same day. Candlesticks are created by up and down movements in the price. Creating a trading plan could assist a trader in staying disciplined by following the specifications set out in their trading plan. Once the price breaks out of the support line, it could be a possible signal to take a short position as the market is likely to reverse to the downside. These bands represent a volatility channel around the moving average price. The recommended timeframe for scalpers is the 1 hour chart; however, you will be making use of the 1 minute, 5 minutes, and 15 minutes charts. Price data includes a number of parameters such as the price of the asset, trading volumes of assets, size of the trade, and the information derived from transactions among others. It helps businesses make informed decisions to optimise cost structure. A long straddle strategy involves buying a call and put option for the same asset with the same strike price and expiration date at the same time. For this guide to the best stock apps, we thoroughly tested key features including the availability and quality of watch lists, charting, real time and streaming quotes, stock alerts, and educational resources, among other variables. This kind of forex trading is reserved for super PATIENT traders and requires a good understanding of the fundamentals. Here’s how the premiums—or the prices—function for different options based on the strike price.

How I Made $2,000,000 in the Stock Market

Other types of options exist in many financial contracts. Meanwhile, swing traders open significantly less, sometimes only a few positions spanning a few days or weeks. However, they can be extremely detrimental when they are interpreted incorrectly. Many choices, or embedded options, have traditionally been included in bond contracts. A bearish harami pattern is a two candle pattern. Not all brokerages or online trading platforms allow for all these types of orders. But the SEC explicitly says that day traders “should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. Day Trading With Short Term Price Patterns and Opening Range Breakout.

How to Use HODLing: The Long Term Crypto Strategy

Dana George, writer at The Ascent. 24/7 dedicated support and easy to sign up. “Options: Calls and Puts. Entry and exit decisions must be made with split second accuracy, and any misstep can result in significant losses. Read more about put options. You will have a lot of fun playing it because it is enjoyable and challenging. Crucial for liquidity and efficient trading. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. The language of the book is beginner friendly, and complex topics are explained in the easiest manner.

Recently Published

This article was written, reviewed and fact checked by the expert team at Nuts About Money. Their resources allow them to capitalize on these less risky day trades before individual traders can react. Therefore, not letting your emotions get the best of you is important and can help you avoid making irrational and hasty decisions when trading. ” Scalpers can place anywhere from a few to one hundred plus trades a day, always attempting to turn a small profit with each individual trade. Intraday trading, also called day trading, is the buying and selling of stocks within the same day. While the pattern is forming, it can be difficult to predict what will happen. Buying and selling crypto on the Kraken app is definitely a hassle free process that doesn’t really leave space for failure. In the USA, the E mini SandP 500 futures contract has a tick size of $0. Brokerage will not exceed SEBI prescribed limit. To facilitate trade, the bank created the nostro from Italian, this translates to “ours” account book which contained two columned entries showing amounts of foreign and local currencies; information pertaining to the keeping of an account with a foreign bank. If you look at a Marubozu candlestick, the first thing you will notice is that it has only a body and no tail, wick, or shadow. “Now it’s an arms race,” said Andrew Lo, director of the Massachusetts Institute of Technology’s Laboratory for Financial Engineering in 2006. You’re welcome, Joseph. Fido’s app will satisfy almost every long term investor, but I think its logical layout makes it easier for beginning investors to find useful insights into the markets and their holdings. These financial instruments include equities and exchange traded funds ETFs. Professional traders do not trade to win a particular trade. Interactive Brokers is a highly trusted multi asset broker with an extensive offering of tradeable global markets.

Equity delivery Brokerage Charges

According to the SEC in the US, a conviction for insider trading may lead to a maximum fine of $5 million and up to 20 years of imprisonment. The price moves between the two bands and the distance between them tells you the market’s volatility. This thorough introduction explores the subtleties of tick charts, revealing their importance, interpretation, as well as advantages. You can also add a “huge volume” colour to further. Scalping is a trade done within a time frame between 5 seconds to 2 3 minutes. A trading patterns cheat sheet, or price action patterns cheat sheet, is a quick reference guide for identifying and understanding different chart patterns. Investments in securities markets are subject to market risks, read all the related documents carefully before investing. I also provide a different view on candlestick analysis and explain the most common problems traders have with price action trading. It is estimated that more than 75% of stock trades in United States are generated by algorithmic trading or high frequency trading. Simply Go to “My strategies” and then click on “Deploy”. Book: Fooled by RandomnessAuthor: Nassim Taleb. The company’s global operations are regulated with strict licenses from the U. Here is the detailed MCX Holiday List 2024. The formations and shapes in candlestick charts are used to identify market direction and movement. Discover more about trading the volatile – and risky – cryptocurrency markets. The value of your investments may go up or down. Conversely, negative sentiment can trigger fear and caution, prompting traders to sell off assets and adopt defensive strategies. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data.

Mutual Fund

Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. We have not established any official presence on Line messaging platform. For beginners in 2024, the best stock trading apps are Fidelity and Charles Schwab. You can lose your money rapidly due to leverage. Connect online and in person. The interface and navigation is not as intimidating as i have seen on other exchanges, all main functions are easy to find and use. Based on your analysis, you’d apply the strategy you believed would yield the best outcome in a live trading environment under the assumption that similar prices, regulations and market conditions would be at play. The Debt comes in the form of bond issues or loans, while the equity which may come in the form of common stock, preferred stock, or in the form of retained earnings. Keep in mind that high interest can be a contrary indicator. The value of your investments may go up or down. From there, as your confidence and experience start to build, begin to increase your investments gradually. Please see our General Disclaimers for more information. Stock trading involves risks and may not be suitable for everyone. The price at which the contract is entered is the strike price or the exercise price. Get all of your passes, tickets, cards, and more in one place. ETRADE’s trading platform is easy enough to navigate for beginners and sophisticated enough for advanced traders, however, its margin interest rates are somewhat steep, particularly for small investors. Whether you aim for long term growth, short term gains, or a mix, understanding your goals is crucial to establishing a strong foundation for choosing the right platform to fit your needs. Real time market data. Unregulated binary options brokers don’t have to meet a particular standard—or any. At the forefront of this is that the platform only hosts European style options.

Intraday Trading Timing in India

We typically tell our students that they need at least $20000 $25000 if they want to trade futures, in order to keep the risk at an acceptable level. The Day Trader: From the Pit to the PC. You can download it for free from this website. And trading speeds are fast. These criteria are developed by analyzing factors such as revenue growth and profitability. Counterparty credit risk in the trading book is dealt with by BIPRU 14. The “handle” forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Step 2: Register Using the Official Website of the Broker. Head and Shoulders Pattern. To freely day trade stocks in the US requires an account balance of at least $25,000, but this is not the case with futures. Select your country of residency below to see which regulated forex brokers will accept you as a new customer for trading forex. Those who rely on technical indicators or swing trades rely more on software than news. During this phase, manipulation of prices is achieved that creates sufficient liquidity for resuming the preceding trend.